CloseConnection slow - Try reload

Money 101

First things first, we cannot get a budget or income needs decided until we understand exactly what you need.

This could be for you on your own, you and a partner, or for your whole family. It doesn’t matter who is included, what counts is writing down the specifics of what you need to fist survive, and then secondly to grow! So, it is always best to start off with the essentials ….

This includes things such as rent, water and lights, food, and transportation. Note that food refers to groceries, and not restaurants and take-aways!

Next you need to make payments to your creditors i.e., car loan, store accounts,

cell phone provider, internet provider etc. You also need to pay your debit orders

i.e., medical aid, insurances (if you have these in place), schooling (whether

tertiary for yourself or primary/secondary if you have children) etc.

Non-essential spending would be memberships, subscription services, services you may be paying for but could be doing yourself (i.e., hair or beauty salon treatments, pet parlour grooming for your pet, or car wash etc.) and any other luxuries.

The best way to see what all of these things cost you is to check your most recent

three months bank statements. If you have not made a budget before you will be really surprised what comes up on your statements. Often, we spend money on things that really are not important but are fun purchases.

Put these costs into categories and you will now have a list of the financial needs you have for yourself and your family every month!

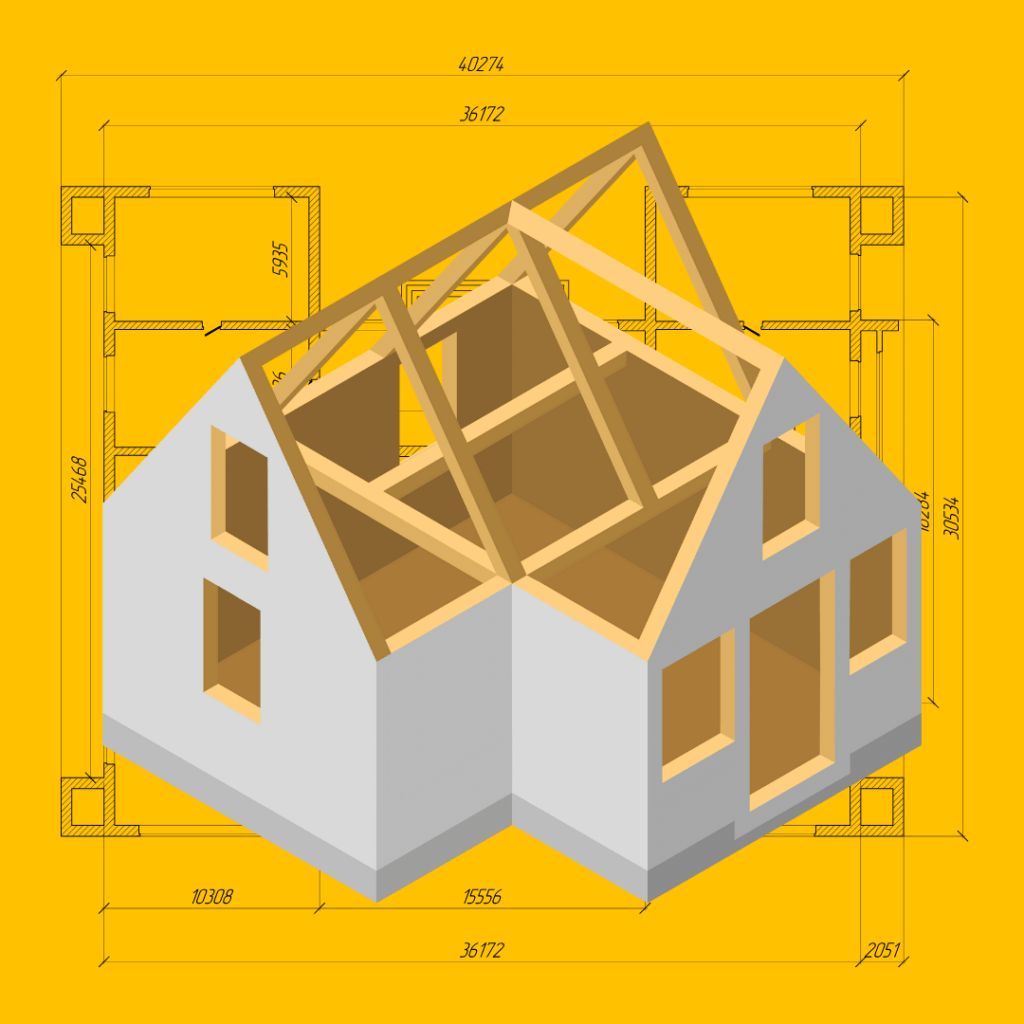

Now that you have a good understanding of what costs you have and what kind of income you need each month, you can start to set your goals.

What we can afford every month is often short of the type of lifestyle we want to live. This wont change on its own, and we need to start doing different things to make it happen. But how much is enough? This is why we need to set goals we can aim for.

Each goal needs to be realistic and within a time frame that is not too far away. Start by setting goals for the year ahead, decide how much money you want to have for different targets and goals in your life and see if it is possible to make it happen. This could be things like growing a savings pocket to R5k, buying your first car, moving out of your flat, or saving up for educational goals.

No matter what the goals are, keep them realistic, and then find a way to get there! From starting a side hustle, to cutting out non-essential spending. You should be motivated enough by the goal ahead to want to do the hard stuff!

Continue with your lesson to find out …

.